TAX BREAKS… For Small and General Business

It’s not law yet, but the Government’s “National Building and Jobs Plan” rolls on with the proposed Small Business and General Business Tax Break announced on the 3 February 2009. Passed by the Upper and Lower House it now appears destined to become law very soon as reported by MEAD PARTNERS.

AIMED to assist individuals and businesses during the current economic situation, it is estimated to provide a $2.7 billion one off tax break for businesses in Australia. This tax break is in the form of a 10% or 30% deduction of the cost of an asset purchased between 13th December 2008 and 31st December 2009. For example: for an asset costing $100,000, a one off deduction of up to $30,000 may be allowed in addition to any depreciation that may be claimed.

The tax break is available to any taxpayer in Australia (including individuals) that carries on a business. The deduction is claimed in the taxpayer’s income tax return in the year that the asset is held and ready for use.

The calculation of the tax break is straight forward; multiply the asset’s cost (GST exclusive) by the relevant percentage.

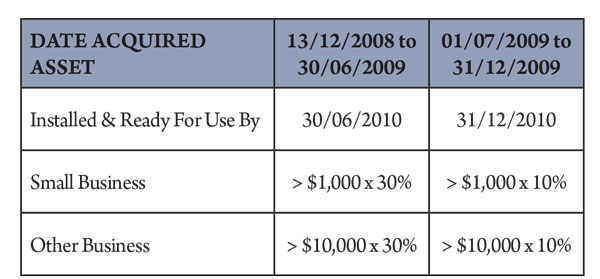

The relevant percentage of either 10% or 30% rate is entirely dependent on when the asset was purchased and installed ready for use:

An asset will be deemed to have been purchased if the taxpayer has entered into an acquisition contract or the asset has commenced construction.

Please see the handy flow chart (available from Mead Partners or directly from the CMPA) to test your eligibility.

It should also be noted that the tax break is a bonus deduction and will not reduce the amount of any depreciation entitled in future years or any profits (or losses) made on the sale of the asset.

While the tax break will apply to a large number of assets purchased, there are some assets that are excluded from being eligible for the additional deduction.

EXAMPLE ONE

A small business (i.e. turnover of less than $2M) purchases two assets, the first for $4,000 and the second for $900. The $4,000 asset is above the relevant threshold and the tax break is available in addition to any depreciation that would normally be claimed. The $900 asset is not eligible and no tax break is allowed.

EXAMPLE TWO

A business that is not a small business (i.e. turnover of more than $2M) buys two assets during the year, one for $8,000 and one for $12,000. The $8,000 asset is not above the relevant threshold and therefore the tax break is not allowed, however it can be depreciated as normal. The $12,000 asset is greater than the relevant threshold and therefore it is entitled to the tax break in addition to any depreciation.

The tax break can only be claimed on any asset that meets the following criteria:

- The asset is a new asset including demo’s (not second hand)

- The cost is greater than the relevant cost threshold (see further)

- The asset can normally be depreciated under Division 40-B of ITAA 1997 except: land; trading stock; a right to mine, quarry or prospect; information regarding mining, quarrying or prospecting.

- It is a tangible asset

There are also a few items that are excluded or need specific clarification:

- An asset is deemed to be new if it has not been used by anyone, anywhere. However, in saying that, if an asset has been used by someone else for trialing or testing, it is still considered new. This would therefore appear to include demonstrator vehicles as a new asset.

- The tax break for the purchase of a car is capped by the luxury car limit – currently $57,180.

- Primary production assets depreciated under Subdivision 40-F of ITAA 1997 are not eligible.

As mentioned above, cost is one of the eligibility criteria. This is where the asset’s relevant cost threshold comes into play. The relevant cost threshold is a certain dollar figure, below which the tax break cannot be claimed on assets.

The relevant threshold for small businesses is $1,000 (see Example 1) and the relevant cost threshold for all other businesses is $10,000 (see Example 2). A small business in this case has the meaning of Division 328, ITAA 1997.

That is, you will be a small business if your turnover last year was less than $2M OR it is likely to be less than $2M this year.

WHERE TO FROM HERE?

Essentially the passage for such a change in tax legislation is:

- Propose a “Bill for an Act to amend the law” – done and passed on 18th February 2009.

- Exposure Draft (ED) is then released for comment – released 23rd February 2009.

- The ED is passed as law in Parliament – yet to be done.

So, until Parliament passes this as law it is a perfect opportunity for you and your business to review your tax position in readiness for the legislation to be passed.

The Exposure Draft , an explanatory memorandum and a FAQ sheet can all be found on the treasury’s website www.treasury.gov.au

CHECKLIST FOR CLAIMING

- Does the asset purchased meet the criteria?

Yes – continue

No – Ineligible - Are you a small business?

Yes – Go to question 3

No – Go to question 4 - Does the asset cost more than $1,000?

Yes – Go to question 5

No – Ineligible - Does the asset cost more than $10,000?

Yes – Go to question 5

No – Ineligible - Was the asset purchased between 13th December 2008 and 30th June 2009 and installed, ready for use by 30th June 2010?

Yes – Go to question 6

No – You are entitled to a tax break of 30% of the asset’s cost - Was the asset purchased between 1st July 2009 and 31st December 2009 and installed, ready for use by 31st December 2010?

Yes – You are entitled to a tax break of 10% of the asset’s cost

No – Ineligible

Please consult your accountant to determine if the asset being purchased is eligible for the tax break.

If you require any advice or assistance please don’t hesitate to contact Mead Partners Chartered Accountants, on 03 9523 2277 a preferred supplier of the CMPA.

You must be logged in to post a comment Login