What insurance is right for you?

JARROD WATSON, Senior Account Executive for Coverforce Insurance Broking Victoria Pty Ltd reports on renewing your insurance.

Insurance is one of those must haves for every business. Whether it is a desire for protection in an emergency, requirements by law or a condition of a contract, insurance is quite simply a must have for a business to operate in the 21st Century.

In Australia we are spoilt for choice with dozens of different insurance products available from over a hundred providers. However understanding what insurance your business needs and should have can be a difficult proposition. For many businesses the process can be time consuming and confusing and the consequences of getting the wrong insurance can leave a business facing huge financial burdens or even the inability to continue operations. With resources limited at the best of times it is an unwelcome responsibility left to many business owners to struggle through.

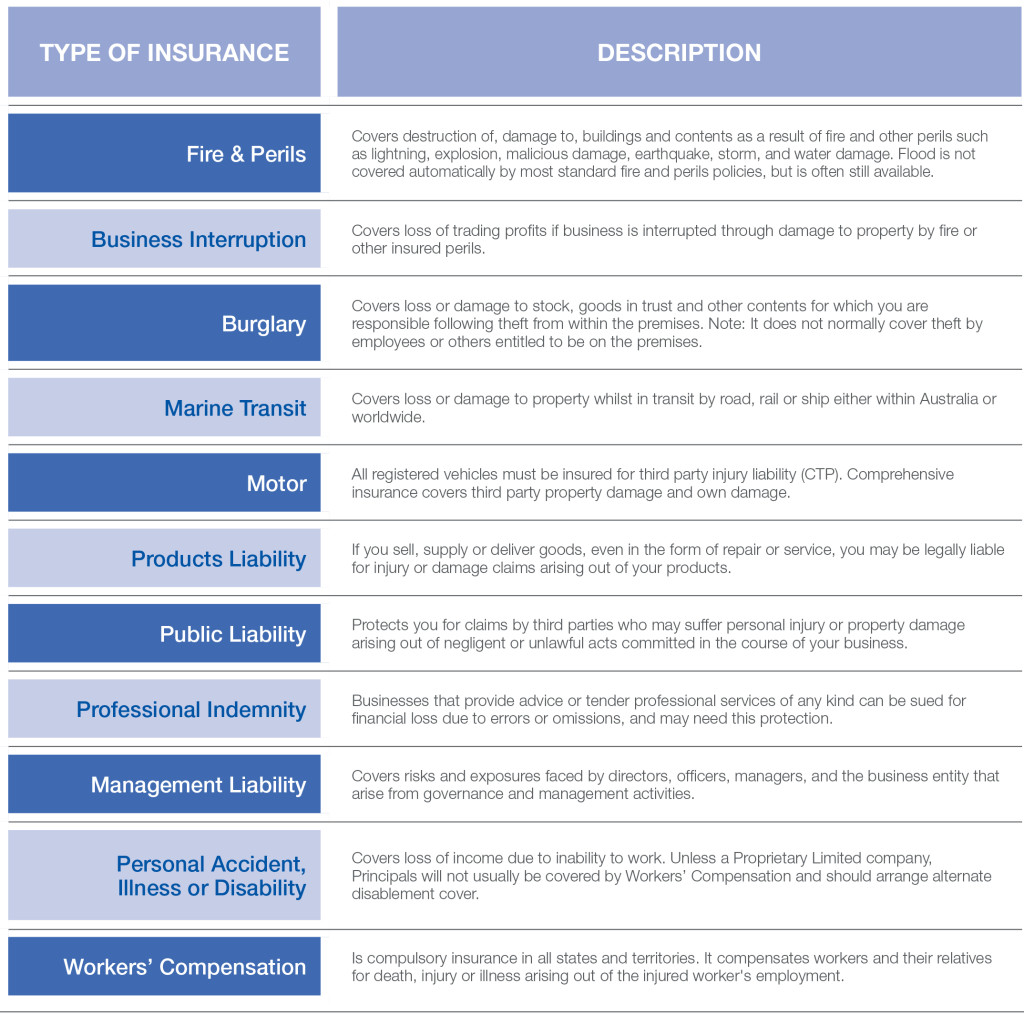

As a CMPA member you are likely to come across and need insurance that utilises some or all of the following common insurance products and covers. The below table is by no means exhaustive, however it is a good starting point in developing an insurance program for your business:

Understanding just one of the above insurance products can be difficult enough with all the terms and conditions, let alone the many different products and options a business will potentially need or want. This is where an insurance broker can help. Armed with expert insurance advice, informed decisions will be easier to make about what to insure, or which risks to carry and manage as part of the business. They are trained to identify your business needs and ensure that you are properly protected. They have the experience and knowledge to find the products that are right for you.

Using a broker doesn’t necessarily cost more. Often it costs less because brokers have knowledge of the insurance market and the ability to negotiate competitive premiums on your behalf. In addition, because insurance brokers deal with a range of insurance companies directly, sometimes they can access policies that are not available to most consumers.

If the worst happens and you do have to make a claim, a broker will act on your behalf, liaising with the insurance company to negotiate the best possible outcome for you the client. Insurance Brokers are the best, most trusted source of advice available to make sure you are properly protected.

Whilst anytime is a good time to review your insurance, it is generally on renewal when most businesses are reminded about what insurance they currently have. Renewal therefore presents the perfect time for businesses to conduct a full review of their policies and consider if their business circumstances have changed during the past year. These changes can include moving locations, hired more staff, taking on new projects, an upgrade in equipment, or your business has simply expanded or contracted. A common mistake that is made by most businesses is leaving their policies unchanged from year to year The reality is that any change in your business circumstances is likely to alter the conditions of your insurance and may even expose your business to new risks that need to be reflected in your policies. To ensure that you are properly protected it is important that you have a discussion with your insurance advisor prior to renewal.

At Coverforce our passion is to provide you with a range of solutions which help mitigate risk from your balance sheet. Risk management advice, planning and assessment are all part and parcel of the Coverforce difference. As trusted advisors, our qualified and experienced brokers deal in all classes of General Insurance and specialise in a range of industries and sectors in ensuring our clients have access to best-practice, the latest products and world class servicing. Using their understanding of your business and extensive industry experience, our brokers are able to determine the coverage and applicable limits required for the reliable protection of your business and personal assets.

Coverforce prides itself in providing smart insurance solutions that represent true value to our clients.

At Coverforce we can not only assist with finding you the right product but they can also help with the following specialist services:

- Contractual Reviews

- Workers Compensation Reviews

- Risk Management Advice

- Insurance Program Design & Implementation

- Reinsurance Broking

For a no obligation quote please contact Jarrod Watson on 03 9864 4444.

You must be logged in to post a comment Login