ERR 2023/24 Annual Statistical Report

DR ELIZABETH GIBSON, General Manager of CMPA, reports on the ERR 2023/24 Statistical Report.

Earth Resources Regulation (ERR) has recently released (December 2024) the 2023/24 Annual Statistical Report (available a https://resources.vic.gov.au/).

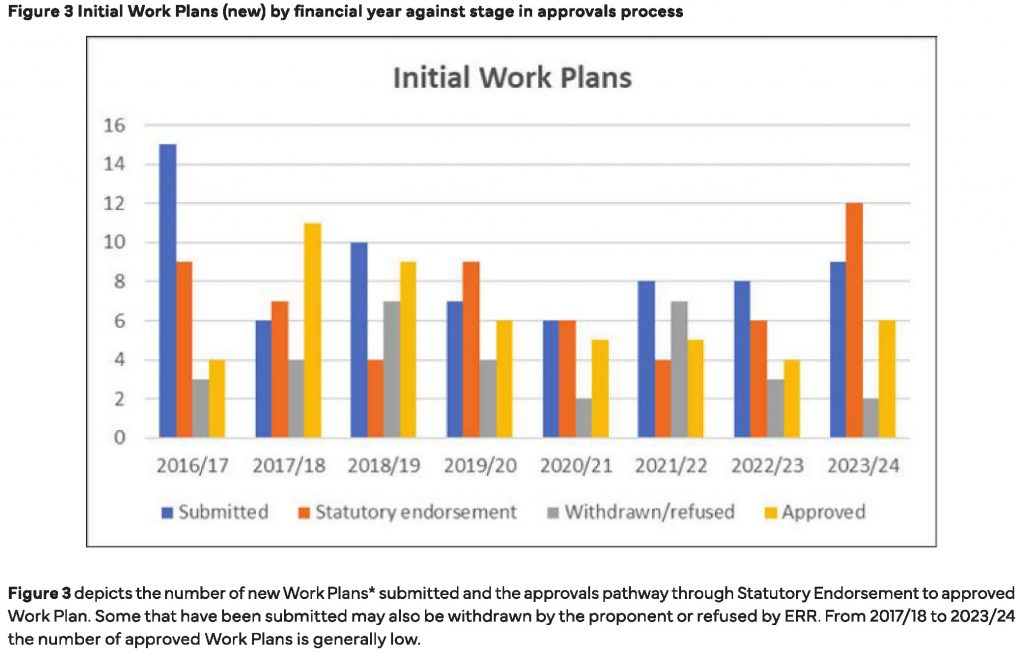

A downturn for 2023/24 in annual construction material tonnages has occurred. This is due in part to reduced Government funding on roads maintenance.

However, it was noted that ERR had amended the tonnages for the previous four financial years (in comparison to figures shown in the relevant past statistical reports). Due to these amendments, published comparison figures for past rock type ($/tonne) cannot be presented with any accuracy.

*Sedimentary (usually rippable rocks, including sandstone, shale, siltstone, chert, mudstone, claystone).

*Concrete sand (product type) was included for information.

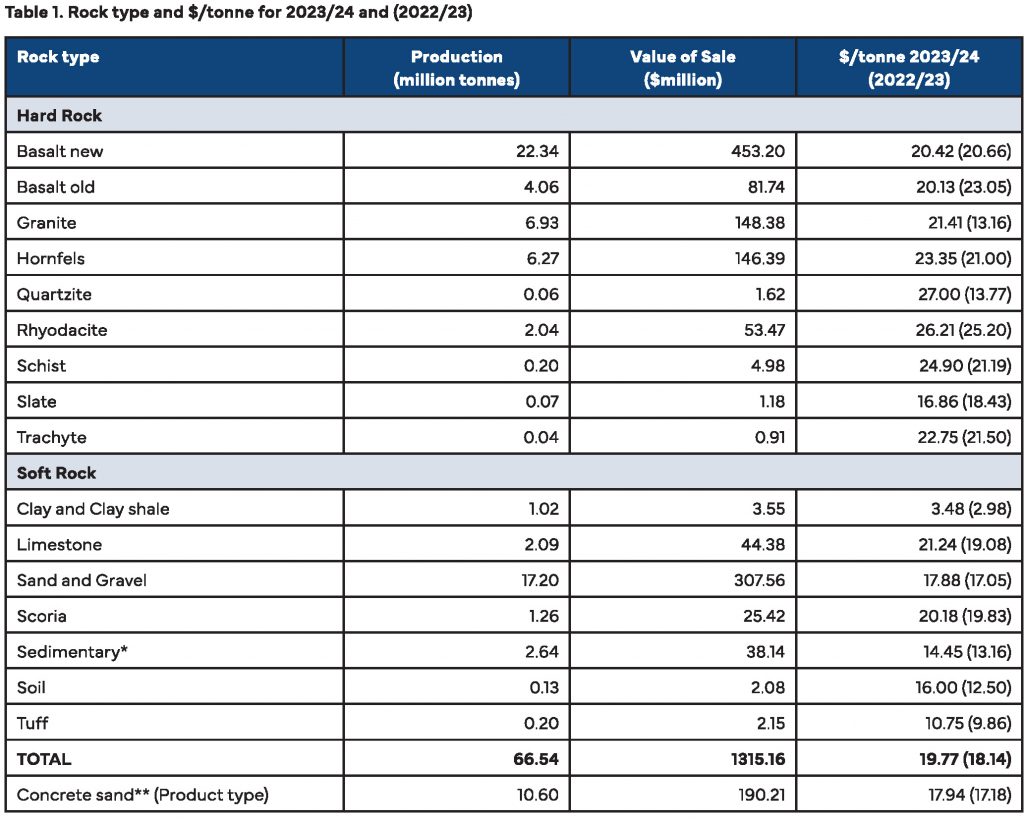

Figure 1 gives the production in tonnes; $ per tonne and projected tonnes of construction material against the financial year. It can be clearly seen that the:

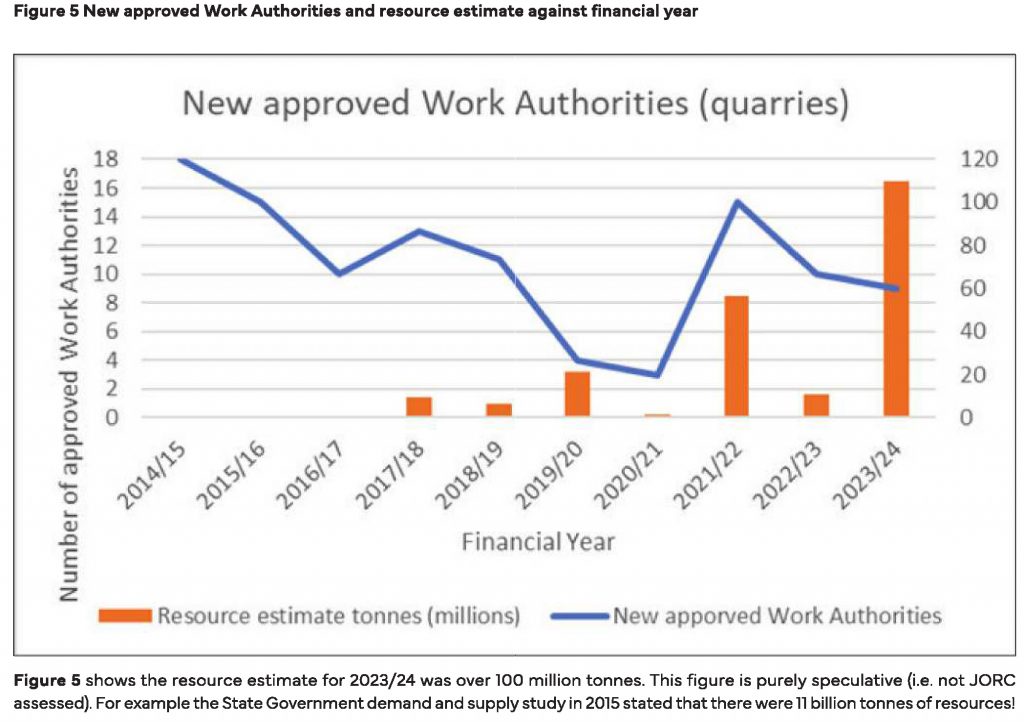

• The Victorian Government Extractive Resources Supply and Demand Study 2015-2050 underestimated the future needs for construction material in Victoria by approximately 19% (13 million tonnes) for 2023/24.

• The average unit rate ($/tonne) has increased by 9% indicating that the predicted shoratage of supply is imminent.

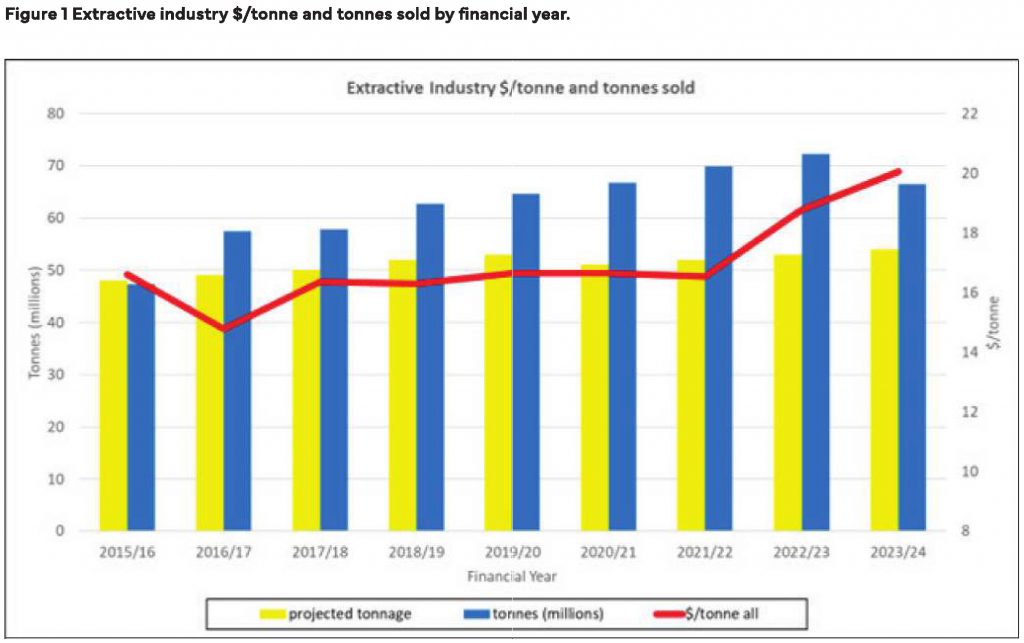

Figure 2 raises concerns that the total number of Work Authorities is declining . What would be interesting is for ERR to state the number of WAs predicted to close in the next 10 years. This becomes even more evident when considering only those Work Authorities actively producing construction material (green column). Not included in Figure 2 are the tonnages for the production of recycled construction and demolition waste which is approximately 6.5 million tonnes in Victoria (2019/20), https://www.sustainability.vic.gov.au/research-data-and-insights/waste-data/annual-waste-data-reports

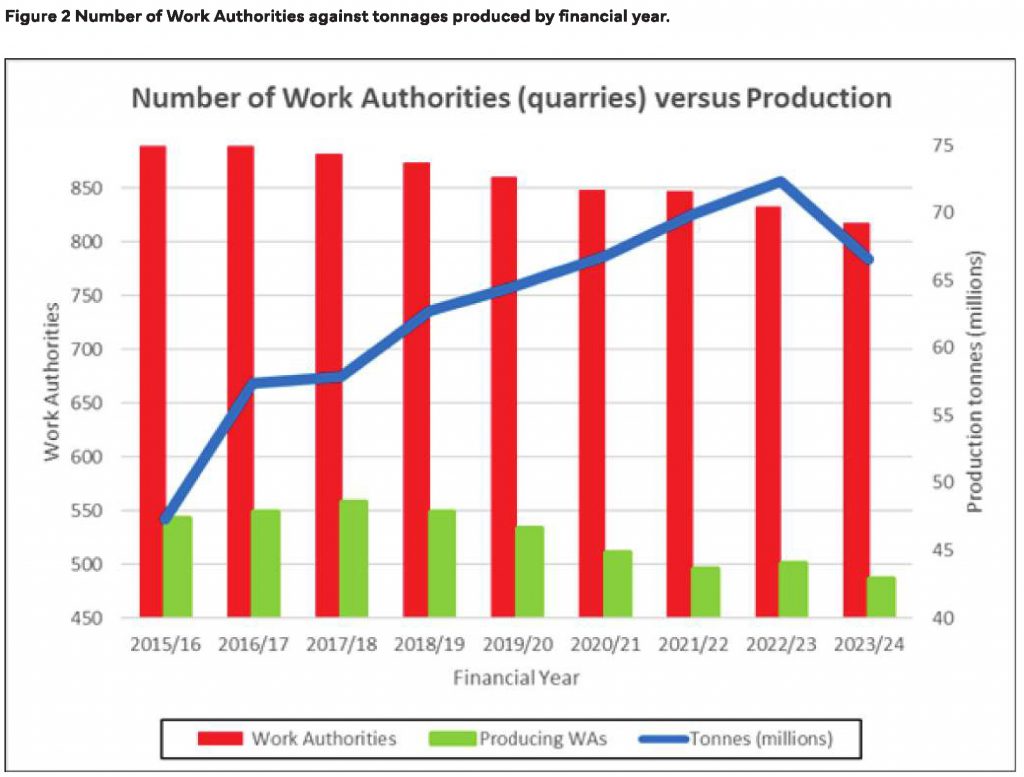

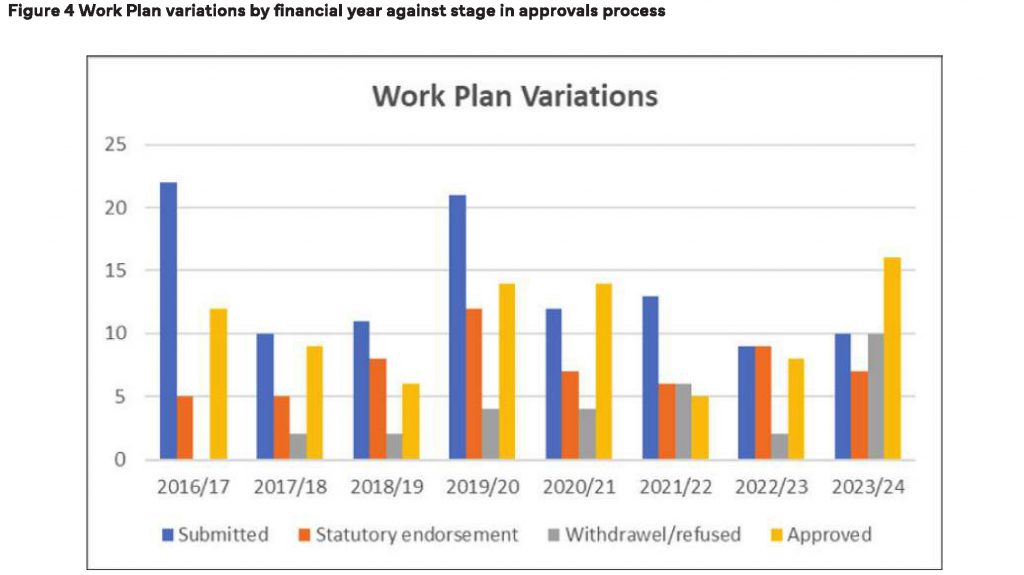

*Until the Work Authority (WA) is granted, an approved work plan does not provide security to the resource described in the Work Plan. Other Government agencies may change their regulations etc. in the interim which until the WA is granted may still influence/change the Work Plan.

Note: the 2024/25 figure is as at 6 January 2025.

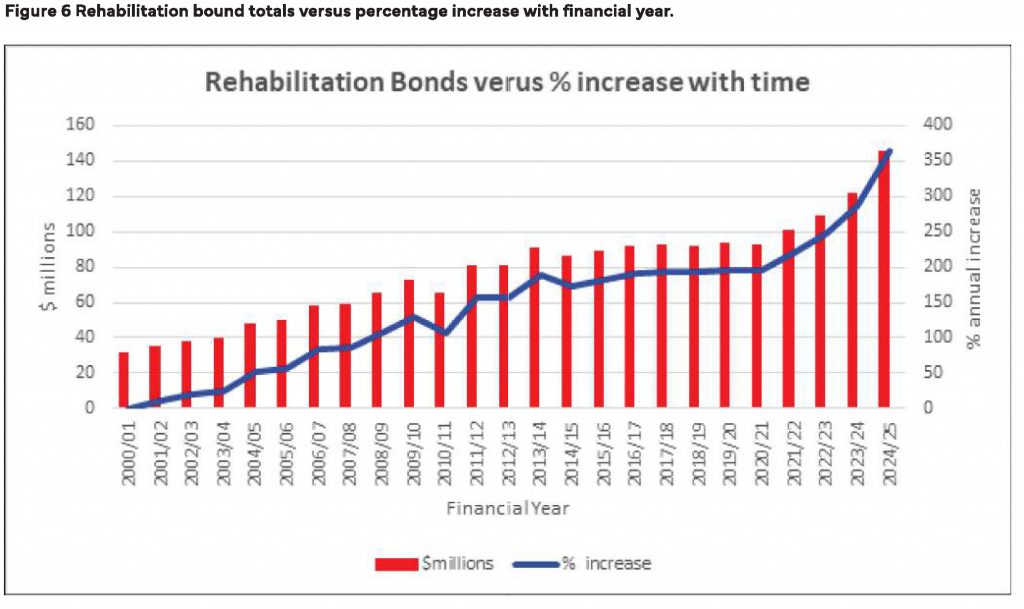

The steep increase in the rehabilitation bonds is due to ERR having modified the rehabilitation bond calculator in 2020/21.

Some CMPA Members are experiencing unwarranted sharp increases (up to 4000% in some cases) in rehabilitation bonds that impact the financial viability of the operation. However, this appears to not have heavily impacted Mineral Licences (including coal mines): from 2016/17 to date the higher risk Mineral Licences have had an increase in 3% in rehabilitation bonds whilst Work Authorities over the same period have had a 59% increase.

Note that $142 million post tax income has been sterilised in 2024/25.

The manner in which the rehabilitation bond calculator is applied by ERR is resulting in the disproportionate application of regulation leading to a distinct competitive advantage to Work Authority holders that have not had their bonds reviewed (currently the majority), and, hence, is an unreasonable regulatory process. Construction material prices are already increasing: 9% in 2023/24 at a rate greater than inflation. Further increases in construction material costs would result in (if this unreasonable regulatory process continues) dire implications for Victorian Government Major Projects and housing construction if these rehabilitation bond increases are applied across the industry. There is no evidence of need for these increases given the good historical track record of the extractive industries with the Victorian Government having undertaken negligible rehabilitation of extractive industry sites over the past 25 years. Additionally, the majority of Work Authorities are undertaken through a business lease with the private landowner who benefits from the extractive industry activity.

You must be logged in to post a comment Login