BUSINESS UPDATE (Issue 21)

VECCI ECONOMIC UPDATE

Supplied by VECCI www.vecci.org.au

For further information

please contact:

Daniel Sheehan

(03) 8662 5227

[email protected]

IN THE PIPELINE

The CMPA, as always is flat out this time of year preparing for the end of financial year tasks including the annual audit and membership renewals.

Member s will receive their membership renewal paperwork in the mail by the end of June. It would be greatly appreciated if renewal could be made prior to the AGM on August 13th.

Other tasks that the CMPA is presently completing include quite a number of training manuals. Members are asked to consider the significance of training within their businesses and look into sending people to the CMPA’s courses.

Submissions presently being undertaken by the CMPA have been discussed, however we anticipate several more submission being discovered, and responded to within the coming months.

Workshops planned in the coming 6 months include a transport forum. If there is an issue you would like addressed in a workshop setting, please contact the Secretariat.

Finally, the CMPA will be attempting to ensure that all members are visited this calendar year and as such a number of visits will be occurring over the coming months. We look forward to seeing you then!

Land Tax Budget Review

Sarah Andrew, CMPA Project Manager

Members would by now all be aware by now that there are massive changes due in the area of land taxes. All of the following information is pending legislation being passed in parliament which is anticipated before the end of July.

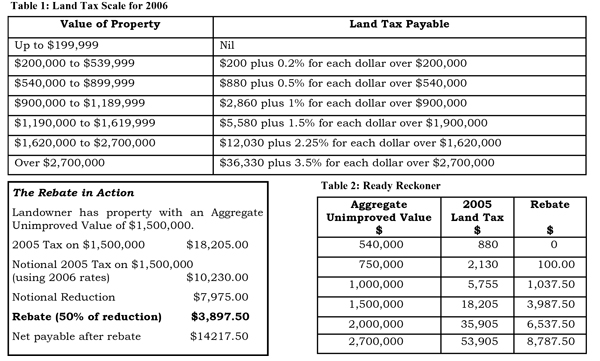

In the 2005-06 Victorian State Budget, the states businesses were presented with revised land tax rates ‘…to provide relief in the middle to top brackets.’. In addition a capping will be introduced to ensure that no sites are burdened with increases of more then 50% over the same property. The new rates are displayed in Table 1.

In addition to these relief measures, the State Budget announced a rebate for ‘…all taxpayers with an assessment that exceed $1,730’. This means all quarries with an assessable value of over $750,000 will receive a rebate with a capping of $8,787.50. Due to the cumbersome wording of the rebate, an example of the rebate in action is shown below.

According to the State Revenue Office (SRO), businesses will not need to take any action to gain their rebate – once the amended amount is established by the SRO, a rebate or advice of the amended amount will be forwarded to you. Furthermore,businesses are informed that they should take on of the following four actions:

- If the due date for payment has not arrived and the assessment is for more then $1,730, delay payment until notified of the new amount

- If paying by installment, pay the first installment by the due date and wait to be advised for the reduced amount payable

- If already paid in full, the SRO will pay the rebate as soon as possible

- If not yet assessed, the assessment will be issued including the rebate

Finally, a Ready Reckoner is available on the SRO website to give business a quick estimate on potential rebates, however see Table 2 for a summary.

If you require any further information, please contact the State Revenue Office through the following details:

Telephone: 13 21 61

Fax: 03 9628 6222

Email: [email protected]

Website: www.sro.vic.gov.au

Note: The information from this article has been taken from the information provided on the website of the State Revenue Office as at May 4, 2005.

Long Service Leave Changes

Supplied by VECCI

A Bill has been introduced into State Parliament aimed at delivering enhanced long service benefits to Victorian employees. The Bill makes separate changes to the current legislative framework including:

- Enabling long service leave to be taken after an initial period of 10 years service, instead of 15 at present

- Giving access to pro-rata long service leave payments to employees on termination after seven years, instead of 10 years as currently applies

- Any period of long service leave would be extended by the number of public holidays falling during the leave period

- Service for long service leave accrual purposes would continue to accrue while an employee was off work on a period of paid parental leave

CMPA Website Update

Briony Rowley, CMPA Administration Officer

The CMPA has recently spent a great deal of timing updating the Association’s Website. The new format now includes a number of interesting features including:

- Membership information

- Associate Member listings and hyperlinks

- CMPA publication listings and descriptions

- CMPA training facilitation and course details

- Numerous downloads including current and archive issues of the CMPA News

- A ‘Contact Us’ section in which emails can be directly sent to the CMPA regarding any questions or queries visitors may have

We encourage all Members and Non-Members to view the Website with any comments being greatly appreciated: www.cmpavic.asn.au

The CMPA plans to undertake further work in the near future on the website, including the possibility of a ‘Members Only’ section. Please direct any comments regarding the website to Briony Rowley at the CMPA Secretariat.

You must be logged in to post a comment Login