Cheaper Fuel FOR THE QUARRY INDUSTRY

You may have heard the whisper – The extractive industry will be able to claim fuel tax credits on their next BAS. For those of you whose accountant hasn’t briefed them yet, here is the low down! SARAH ANDREW, CMPA Project Manager reports.

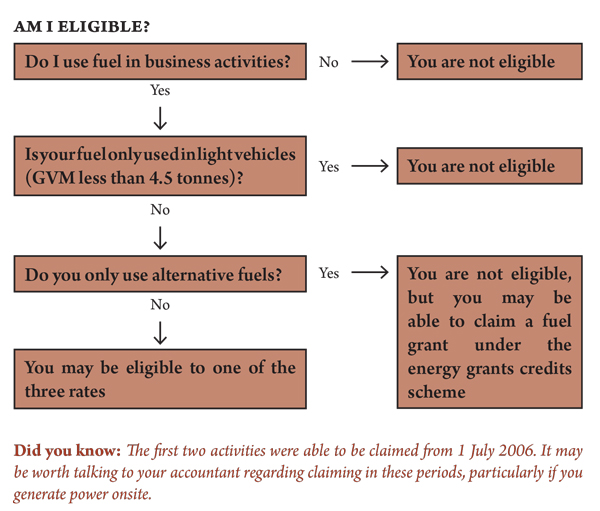

AS from 1 July 2008 most businesses will be able to claim fuel tax credits. If you haven’t checked in a while, you might want to check again!

To date, businesses have been able to claim for fuel used in heavy vehicles (with a GVM above 4.5 tonnes) travelling on a public roads and for activities such as agriculture and mining.

Now businesses can also claim fuel tax credits for the diesel and petrol used in a wide range of activities that weren’t previously eligible, including machinery, plant and equipment used in activities such as the extractive industries.

To claim fuel tax credits for these activities, businesses must have acquired the fuel on or after 1 July 2008.

EXAMPLES

Some examples of eligible business equipment include:

- Asphalt pavers

- Backhoes

- Bobcats

- Bulldozers

- Cement mixers

- Compactors

- Compressors

- Cranes, hoists and winches

- Crushers

- Drills

- Excavators

- Front end loaders

- Graders

- Pumps

- Rollers

GET ON BOARD

If your business is registered for GST but not fuel tax credits, phone 13 72 26 at any time – make sure you have your ABN and tax file number handy when you call.

The next time you receive your BAS, there will be an additional field for fuel tax credits.

Once you are registered, follow the following steps to work out how much to claim:

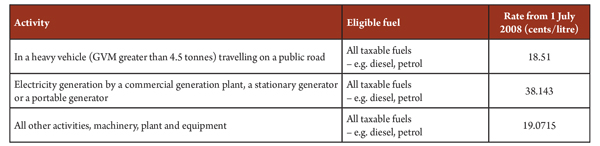

- Work out how many eligible litres of fuel you have used (split into different activities)

- Check the applicable rates

- Work out your fuel tax credits in dollars by multiplying the number of eligible litres by the relevant fuel tax credit rate

This information then gets filled in on your BAS in the appropriate field.

For further information talk to your accountant. Alternatively, get a hold of Fuel tax credits for business (NAT 14584) fr om the ATO either by phoning 1300 720 092 or visiting their website www.ato.gov.au

You must be logged in to post a comment Login