Unit Rates for specifi c rock types?

Every year the Department of Primary Industries publishes an annual statistical review for the previous 12 months. Over the next few editions of the Sand & Stone the Secretariat will discuss some of the trends this information highlights. In this edition CMPA General Manager, BRUCE MCCLURE, comments on how unit rates across different rock types fared over the last five years

THE use of statistics is a very important business tool and can provide a valuable insight into our industry. It is important that all Members of the CMPA are aware of the Extractive and Regulation sections from the DPI’s annual statistical review and, if possible, examine the data provided to source valuable information.

When completing your annual DPI returns it is paramount that you understand the importance of providing accurate information as it can end up underpinning future decision making.

The CMPA has combined data from previous annual reviews going back five years to produce graphs that give a clear indication of trends.

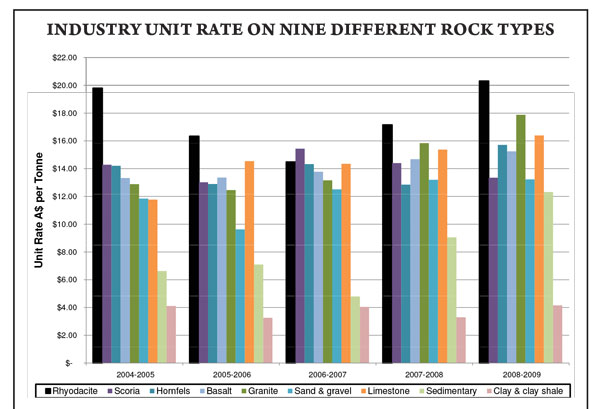

This article concentrates on the period 2004 – 2009. The graph indicates industry unit rates on 9 different rock types.

It should be noted that the rate for each type of product is based on the total sales tonnage for a particular year divided by the total sales value for the same year as provide annually by the industry to the DPI.

The data provided in this graph is accumulated from the whole state and as such cannot reflect site specific issues such as the cost of isolation, rated capacity or the market competition.

It can be noted that during the period detailed there has been a massive increase of business financial compliance requirements including but not limited to bonds, workplan variations and applications requiring community engagement plans, native vegetation off sets, AAV obligations, not to mention the forthcoming obligation requiring workplans to be endorsed before a planning permit is approved.

It is also a fact that our resources are finite and future access has generally not been secured to allow growth and expansion without significant financial investment.

As reflected in the CMPA’s recent submissions to both the VCEC and the DPI, it is not unreasonable to have to invest in excess of $1 million to have a work authority issued.

If a company is going to remain viable then it needs a unit rate that allows adequate reward of staff to enhance retention, adequately cover all outgoings (including the repair and replacement of capital equipment) facilitates planning for future growth and, last but not least, provides a reasonable return on the investment to the business owner.

There’s little indication that the unit price achieved over the past five years allows for any of this.

You must be logged in to post a comment Login