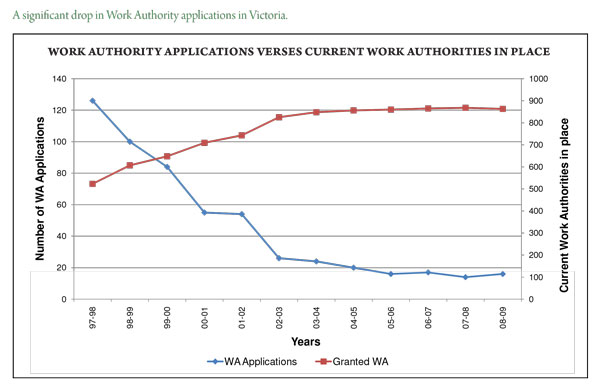

Work Authority Applications Decreasing in Numbers

Continuing our discussion on statistics produced by the Department of Primary Industries, in this edition the CMPA General Manager, BRUCE McCLURE, comments on the fact that the number of Work Authority applications has decreased significantly over the last twelve years and the ramifications of this trend.

THE sign of a healthy extractives industry in Victoria is not only the continual increase in tonnes of quarry products produced across the state but also the industries reinvestment in plant and equipment and probably most important of all, its investment in new sources of raw materials.

The graph below shows clearly that there has been a very significant drop in Work Authority (WA) applications in Victoria over the last twelve years. In fact, there has been an 87% decrease in applications over that period. Th is drop in applications is of concern and should be causing alarm bells to sound at the DPI.

The CMPA has maintained for a considerable time but has been finally able to produce conclusive evidence in its report “An Unsustainable Future” that the prohibitive costs and time consuming hurdles in place to secure construction materials resources in Victoria has serious ramifications for the future of all Victorians unless Government and Industry work together to develop an extractive industry framework which will deliver a sustainable and secure future for the industry.

The unfortunate side of the extractives industry is that it is not an in your face, touchy feely, direct employer of thousands of people producing glamorous products. Most quarry operations involve the use of expensive plant and equipment that is big, produces rock, dust and noise.

It employs Victorians totaling in the low thousands (in excess of 2,500 people directly employed) and yet its impact on the economy of this State is profound. No building, house, road, park, playground is built in Victoria without using a quarry product.

Entry into the extractive industry in Victoria is restricted by a myriad of legislative measures enacted by Local, State and Federal Governments. There is no single regulating body that has particular responsibility for the industry and each Government sector looks at the other when criticism is leveled at the overall impact of regulation.

Without doubt the following points are the main factors contributing to the decrease in investment in the extractives industry. The costs shown are based on real data from surveyed member’s experiences:

- Cost of the approval process. The regulatory compliance cost of the WA process is largely dependent on the complexity of the issues and site and the time taken to gain a decision. Costs ranging from $10,000 to $1.25 million for planning permit approval and $1.9 to $5.1 million for an EES approval. Costs for the almost inevitable VCAT hearing range from $149,800 to $558,251.

- Time Taken to Gain a Work Authority. For standard proposals an average of 2 years from the initial site meeting to the granting of a Work Authority. For more contentious projects involving appeals to VCAT, an average time of at nearly 4 years from initial site meeting to granting of a Work Authority. A project that requires an EES could be expected to take on average 5.75 years.

- Increasing complexity of Native Vegetation requirements. The CMPA report highlights that the current native vegetation framework effectively sterilizes significant resources of sand and stone in the Melbourne area. It is also resulting in major costs across Victoria where substantial vegetation offsets can be required. At present the approximate rule of thumb is that for every acre of habitat proposed to be removed, 5 hectares of other land is permanently offset through caveats and future management and upkeep is required. This must be arranged prior to the approval of the WA.

- Increasing costs and time for undertaking Cultural Heritage surveys of sites and, if needed, the production of a Cultural Heritage Management Plan. In Victoria the Aboriginal Heritage Act 2006 (AH Act) came into effect on 28 May 2007. Controls are no longer based on a Memorandum of Understanding and/or an archaeological report, but now through a Cultural Heritage Management Plan (CHMP) required by the AH Act. These requirements are far more demanding, time consuming to obtain and difficult to predict the result. The regulatory apparatus is still relatively young and therefore both regulators and regulated parties are unsure of the potential depth and scope of the regulatory requirements. Significant cost increases have occurred due to the current cultural heritage requirements.

The above are not all the issues but they highlight the current areas where major change is needed. It should be recognised by all that no one will invest in new business ventures in the extractive industry unless there is a real and ongoing return on investment. Sadly that is not it the case at present.

You must be logged in to post a comment Login