Could your utes be reducing your tax?

JOHN PITITTO, Business Advisor and Business Accountant for MEAD Partners.

While there are many ways to reduce your tax, there could be tonnes of opportunity right in front of you: Your quarry’s utes.

As well as a great employee benefit, your company vehicles could be exempt from Fringe Benefits Tax (FBT). In turn, putting money back in your pocket come tax time.

Let us recap: What’s Fringe Benefits Tax?

Keeping it simple, Fringe Benefits Tax (FBT):

• Applies to any non-salary employee benefits

• Is paid by employers

• Applies to the private use of company-registered vehicles

The good news is, there are exempt industries and quarries are on the list. However, there are some exemption rules.

5 steps to assess if your ute is FBT exempt

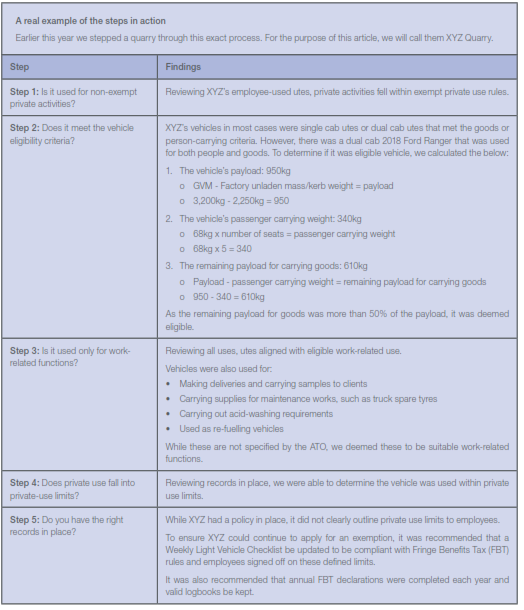

Here are five steps to assess your vehicle’s exemption.

Step 1: Is it used for non-exempt private activities?

There are certain private activities exempt. These include:

• Travel between home and work

• Travel that is required for work

• Minor, infrequent or irregular non-work tasks (such as using

it occasionally for a tip run)

Any activities outside of this may not be exempt, and Fringe

Benefits Tax may apply.

Step 2: Does it meet the vehicle eligibility criteria?

To be eligible, your ute must be either:

• A single cab ute

• A dual cab ute, designed to either:

o Carry a load of 1 tonne or more

o Carry more than 8 passengers (including the driver)

o Carry a load of less than 1 tonne but is not designed for the principal purpose of carrying passengers.

It also must be less than the GST-inclusive luxury car limit, which at the time of this article (19 June 2023) was $71,849. They also cannot be part of a salary-packaging or additional remuneration packages in-lieu of a vehicle.

Have a dual cab that carries people and goods? If the passenger carry weight is less than 50% of the vehicle’s payload, it will be considered a goods carrier. I have included an easy way to calculate in the case study towards the end of this article.

Step 3: Is it used only for work-related functions?

There are a number of activities the ATO deems as ‘work-related.’

These included:

1. If the vehicle is required for work duties

2. The frequency and distance it is used

3. Where the vehicle is used

4. The purpose of its use

5. If it is used to carry tools or equipment needed for the job, and.

5a. They are bulky and can only be transported conveniently by vehicle

5b. There is no secure storage on site and they need to carried to and from site in the vehicle

Of course, there are other valid work-related uses not on the list. I have included a couple of valid uses in this article’s case study.

Step 4: Is private use within private-use travel limits?

For your vehicle to be exempt its use must be limited to:

- Travelling between home and work.

With diversions of up to 2kms from the usual distance permitted

2. Not used for more than 1,000 kms (in total) of travel or for return journeys more than 200kms

This applies to wholly private, non-work-related travel and activities

Step 5: Do you have the right records in place?

Records are essential for Fringe Benefits Tax (FBT) exemptions.

A valid logbook needs to be maintained for every company vehicle, and employees should sign annual FBT declarations. It is also recommended to a vehicle policy which details all criteria.

What happens when your vehicle or its use does not meet eligible private use criteria?

You will need to calculate and lodge your Fringe Benefits Tax return, paying the amount owing. You will also need to check if you need to report the fringe benefit through Single Touch Payroll (or on your employee’s payment summary).

ATO’s regulations and exemptions change over time. This is why regular check-ins with your accountant or business advisor are essential to ensure you stay compliant.

Need clarity or a review on your quarry’s utes? Please do not hesitate to reach out to myself or the MEAD Partners team for advice.

You must be logged in to post a comment Login