Director Liability Law Changes – Know Your Responsibilities

With the ever changing landscape and economic conditions it is important that directors know their responsibilities. If you are or have recently been made a director of a company you need to understand these law changes as this could significantly affect your personal wealth position. JOHN PITITTO, Partner of Mead Partners – Chartered Accountants has detailed the changes below that every director should read.

ON 29 June 2012, the Tax Laws Amendment (2012 Measures No. 2) Act 2012 received royal assent with retrospective effect.

Generally, the Act:

- Extends the director penalty regime to make directors personally liable for their company’s unpaid superannuation guarantee amounts. This also leads to other new changes allowing for similar provisions to arise in respect of the superannuation guarantee charge as for Pay As You Go (PAYG) liabilities. These provisions are non-retrospective.

- Ensures directors and associates cannot discharge their director penalties by placing their company into administration or liquidation when PAYG withholding or superannuation guarantee remains unpaid and unreported three months after the due date.

- In some instances, makes directors and their associates liable to PAYG withholding non-compliance tax (effectively reducing credit entitlements) where the company has failed to pay amounts withheld to the Australian Taxation Office’s (the ATO).

These amendments, and the ATO’s ability to target their application, act to deter company directors from engaging in phoenix activities or using funds from the company for other purposes when they could be paid to the ATO or superannuation funds.

Although stakeholders have argued during consultations that the director penalty regime should only apply to phoenix activities and not all companies, the Government did not agree with this argument and the new legislation applies to all company directors.

AMENDMENTS

The most important amendments are in summary:

- Extension of the Director Penalty Notice provisions to capture unpaid compulsory superannuation contributions (CSC);

- Making a director automatically liable for unpaid and unreported PAYG and CSC, three (3) months after the due date; and

- Directors and their associates employed by a company who have received wages from that company and PAYG was withheld, but not subsequently remitted, are no longer able to claim a credit in their tax returns for that PAYG component. Further, the director or associate may be held personally liable for that component, known as withholding non-compliance tax.

COMPARISON

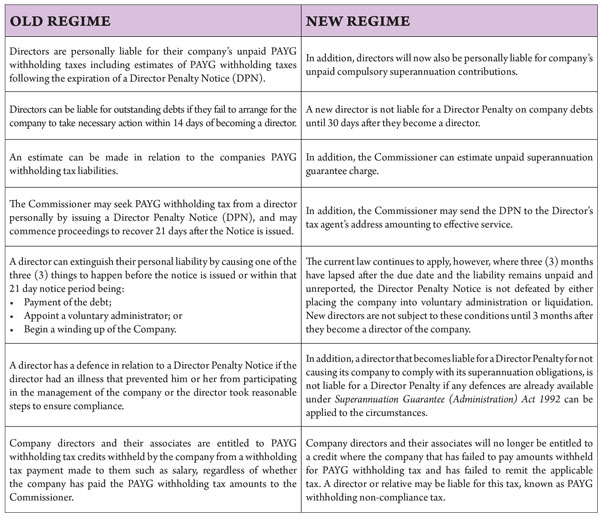

The amendments relate to an election promise made in August 2010 by the Labor Government, and subsequently announced in the 2011/2012 Federal budget. The table below compares the key features of the new and old regimes.

WHAT IF I GET A DIRECTOR PENALTY NOTICE?

In order to recover a Director Penalty from a director, the Commissioner must issue a Director Penalty Notice and wait until the end of the 21 days after issuing that notice before commencing formal proceedings.

A Director Penalty is remitted, if before receiving a Director Penalty, or within 21 days of receiving a Director Penalty Notice, the director:

- Complies with the tax payment obligation;

- Places the company into voluntary administration; or

- Begins to wind the company up.

However, where 3 months have lapsed after the due date, and the underlying liability remains unpaid and unreported, the Director Penalty is not remitted as a result of placing the company into administration or liquidation.

DEFENCES

There are a number of defences available to a director in an attempt to avoid the penalty regime. They are as follows:

- Because of illness or some other good reason the Director was not involved in the management of the company and it was reasonable for the Director to not be involved; or

- The Director took all reasonable steps to ensure that the directors caused one of three things to happen (or not such steps were available)

- The company meet its obligations to pay the company’s noncompliance with PAYG withholding tax and superannuation guarantee obligations; or

- That the company be placed into voluntary administration; or

- That the company be wound up.

A director is not liable to a Director Penalty relating to the superannuation guarantee charge, where they can establish that the penalty resulted from the company treating the Superannuation Guarantee (Administration) Act 1992 (SGAA) as applying, to a matter or identical matters in a particular way that was reasonably arguable and that the company took reasonable care applying the SGAA to the matter or matters.

Should you wish to investigate the changes in detail, we suggest you view both the Tax Laws Amendment (2012 Measures No. 2) Act 2012 and Explanatory Memorandum.

The Federal Government is focused on phoenix operations and protecting employee’s entitlements. Readers are also referred to Corporations Amendment (Phoenixing and Other Measures) Act 2012 and Corporations Amendment (Similar Names) Bill 2012t.

The CMPA is proposing to hold a workshop in early 2013 to discuss the above changes as well as other matters such as newly developed credit form, transport hire agreement and health assessment forms.

You must be logged in to post a comment Login