EER Cost Recovery – Exorbitant Fee Increase 234%

The CMPA submission on the Regulatory Impact Statement: Proposed Mineral Resources (Sustainable Development) (Mineral Industries) Amendment Regulations 2025 and the proposed Mineral Resources (Sustainable Development) (Extractive Industries) Amendment Regulations 2025 (RIS) was prepared in part by Peter Marshall, Director PJM Economics.

Submission

The CMPA supports in principal cost recovery for Earth Resources Regulation, however, the simplistic methodology used to calculate fees unfairly disadvantages the extractive industries (when compared to mines) and further, small work authorities (when compared to large work authorities). In effect the extractive industries are now subsidising mines by an additional ~$4.25 million. Areas such as policy development and regulatory reform are not cost recoverable. Regional geoscientific investigations and other activities of ERR are more specific to mines.

Conclusion

In 14 years, the cost of regulation has nearly tripled after accounting for inflation and industry growth. This is disappointing and before regulatory cost are arbitrarily increased this increase must be investigated and transparently justified.

Even though the RIS 2025 recognises that regulatory costs increase with the complexity and size of businesses there is considerable cross-subsidisation from small businesses to large businesses. An alternative has been offered that substantially redresses this economic distortion.

Note: The RIS continually refers to work plans no longer being required due to the introduction of the MRSD Amendment Act 2023. This is

incorrect due to the Earth Resources Regulator requiring work plans for enforcement and compliance.

Discussion

The Regulatory Impact Statement (RIS 2025) commissioned by DEECA sets out to justify the charging of $21.3m in regulatory costs to the mining and extractive industries. This amount was determined by a report completed by Deloitte in 2024 (Deloitte). The Deloitte report provides no justification or workings as to how the $21.3m figure was derived. This response considers two main issues: the high amount of regulatory cost and the distribution of these costs.

Regulatory Cost

The basic setup of RIS 2025 report is that under the Pricing for Value Guide of the Victorian Government that “Agencies should aim to recover the full costs of service provision to promote efficient consumption” and “The cost of service provision should be borne by those who benefit from the service.” Essentially all costs borne by the regulatory authority should be recovered from the industry(ies) benefiting from the regulation.

In Economic Theory there are sound efficiency grounds for following this method. However, a major issue for the extractive industries is that this assumes that all the money spent on regulation is necessary and efficient. In essence we fundamentally question the premise of the report that the $21.3m is justified. The Deloitte 2022 review determined the figure of $21.3 by determining the split of staff (full time equivalent) and other expenses within the Department.

No effort has been made to determine whether the amount of regulation is justified and the split of expenses that has been used relies on reports done separately for the mining and extractive industries over a decade ago. This will inevitably lead to cross subsidisation across industries and vertically making smaller businesses less competitive. It is noted that a report is slated to be completed in 2027 that updates these reports.

There were detailed reports completed in 2013/14 for the mining and extractive industries ascertaining cost recovery for each industry separately. These reports attempted to fairly distribute costs to activity and according to size of the business.

These reports determined that the mining industries required $2.5 million and the extractive industries needed $1.6 million for a total of $4.1 million across the two industries. Since then, the regulatory regime has these two industries combined. To get a fair comparison to the current ask of $21.3 million for regulatory costs we have allowed for inflation and for real growth in each industry. The 2013/14 reports used 2010/2011 dollars and since then inflation has grown by 43%.

Also there has been real growth in the two industries: 29% for mining and 21% for extractive. Allowing for these two factors the $4.1 million cost recovery in 2010/11 dollars would have grown to $7.4 million which is very close to what is being recovered now. This implies that the original system of cost recovery has worked well and accounted for inflation and real

industry growth.

This begs the question as to why regulatory costs have exploded to $21.3 million. Over 14 years the amount spent on regulation has nearly TRIPLED. Cost recovery is only efficient if it is useful and targeted. It is difficult to imagine why regulatory costs should have tripled in 14 years: it implies that there is considerable inefficiency and waste within the regulator.

Distribution of Regulatory Costs

RIS 2025 recognises that the current regulatory regime will likely severely impact small businesses.

For the extractive industries the current system collects the bulk (88%) of fees from recurring annual fees. These fees are structured in bands measured in dollars.

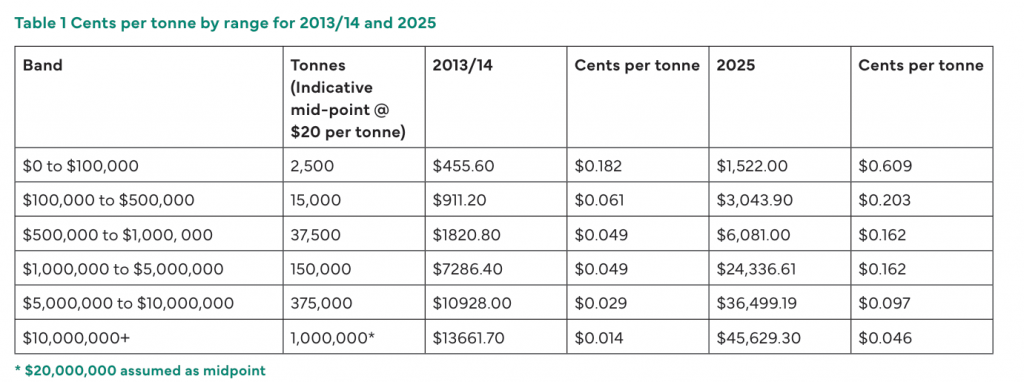

Table 1 shows the price per tonne for the different value ranges. It is assumed that the average price per tonne is $20, and the comparison has been taken at the range mid-point. The point between small businesses and large business is broadly struck at the $10 million annual turnover point.

This table shows that on a per tonne basis small businesses are put at a competitive disadvantage through the diminishing rate per tonne that reflects the regulatory costs for each business. Very small businesses can pay up to 60 cents per tonne. However, one would expect a minimum fixed cost for each business. The pricing structure was not declared in the 2013 and 2014 reports. Any future report into cost distribution must be transparent in how the charges are determined. So naturally one would expect the average cost to fall as businesses progress past the very small stage.

However, as the RIS 2025 states:

“Since large extractive businesses generally create more regulatory effort, resetting fee categories will help to better recover these costs”

This is a clear indication that the largest businesses create more regulatory costs, so it is hard to justify why large businesses are given such a big per tonne discount. As can be seen in Table 1, the effect of multiplying each category by 3.34 has exacerbated the cents per tonne penalty for small businesses. Using averages, the existing fees have 1.5 cents per tonne penalty between the threshold of small/large business threshold of $10 million. This grows to 5.1 cents per tonne under the new rates. (This is just 1.5 cents multiplied by 3.34). RIS 2025 uses the crudest of methodologies to arrive at these new rates. In essence the RIS 2025 report could have been completed in one paragraph.

As the size of the company grows up to over a turnover of $35,000,000 the per tonne rate for regulation for that business falls considerably to around 2.6 cents per tonne in 2025 compared to an average 9.7 cents per tonne for businesses in the $5 to $10million bracket.

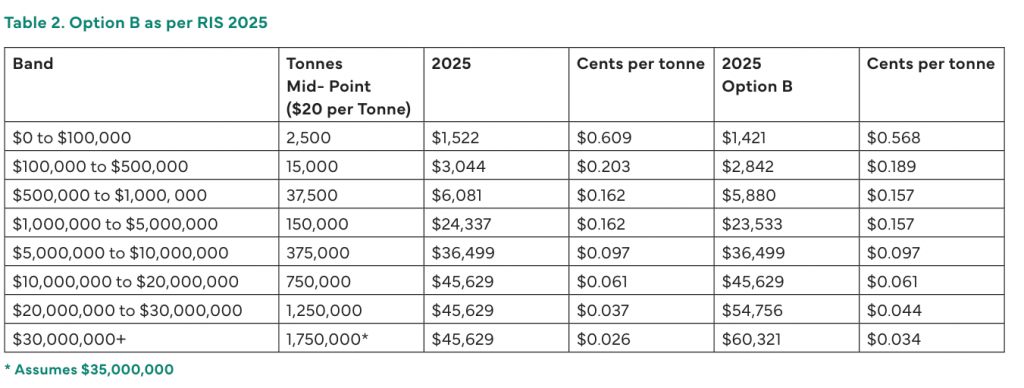

RIS 2025 after consultation offers a revised price structure that creates extra bands for the above $10 million companies up to $30 million

plus (Table 2). This change would just affect businesses above $20 million in turnover with essentially 2 new categories. For $20m to $30m there would be an extra $9,127 per year charged and for $30m plus there would be an extra $14,692. In terms of cents per tonne the effect is minimal. In per cents per tonnes, the net increase for $20m to $30m is 0.7 cents per tonnes and 0.08 cents per tonne for $30m plus. These per tonne rates are still substantially below what is charged for a smaller business under $10m annual revenue creating a distorted competition regime. It is not surprising that the arbitrary Multi-Criteria Analysis (MCA) Option B does not show much difference.

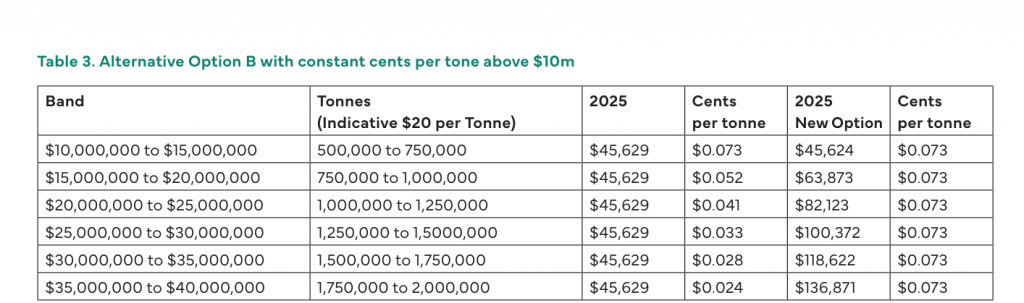

An alternative is offered. In this case, the rate per tonne is calculated for the threshold between small and large businesses. That is for the $5m to $10m band a fixed rate is payable of $36,499. At the upper limit of this band the per tonne rate is 0.073 cents per tonne. ($36,499/500,000 assuming $20 per tonne). Next, we have set this rate across 6 new bands in $5m increments to reflect the scale of the operation. This reflects the comment in the RIS 2025 that regulation gets more complex as the business size increases. It could be argued that the rates per tonne should increase as the business size increases.

As can be seen in Table 3, the fees would increase for the top 5 bands capping out at $136,871 for the $35m to $40m category, but the cents per tonne rate is constant in this scenario across all the bands above $10m. There is not enough information to work out the commensurate falls in the lower levels, but they will be significant in creating a fairer distribution of costs.

In the RIS 2025 report Option B, has an MCA applied to the outcome. It should be noted that this process is entirely arbitrary with no justification given to the weightings and no science applied to the ratings. This is at best art and should considered with healthy scepticism especially when it comes to the final weighted numbers. These are easily manipulated to reflect a desired outcome. Having said that, an alternative MCA to the new option could be:

Efficiency (35%): This alternative option removes the distortion of regulatory costs that favours big business which are more complex to administer regulation. This reduces the burden on smaller firms.

Rating: 5 Weighted rating: 1.75

Effectiveness (15%): similar to option B

Rating 0.25 Weighted Rating 0.0375

Simplicity (15%): There are 4 more categories than Option B but it is still incredibly simple. It means creating a one-off new table with 6 more categories.

Rating -0.5 Weighted Rating -0.075

Equity (35%): Equity is considerably more important than simplicity and the weightings have been reversed. In this case equity between businesses has been dramatically altered although not perfect. The larger businesses could take on a greater share reflecting their higher regulatory cost burden and without more detailed information on where the costs are actually incurred this is a reasonable approximation.

Rating: 7 Weighted Rating 2.45

This results in a total MCA of 4.1625

This result is a significant result and indicates that the alternative proposal (for Option B) has considerable merit.

It would have been helpful to have had access to the 2022 Deloitte review in preparation of this submission.

You must be logged in to post a comment Login