EQUIPMENT FINANCE VIA A CHATTEL MORTGAGE? – PLEASE EXPLAIN!!

Article by Mark Whitla – Heavy Equipment Finance Aust.

Typically, the words ‘Mortgage’ and ‘Equipment Finance’ have never sat well together with borrowers. You could be excused for being deterred, thinking it means that additional security, in the form of bricks and mortar, is required to comfort the bank or financier assisting with the financing of your new wheel loader. And fair enough! Who wants to put up their family residence or other property for the purchase of any capital asset?

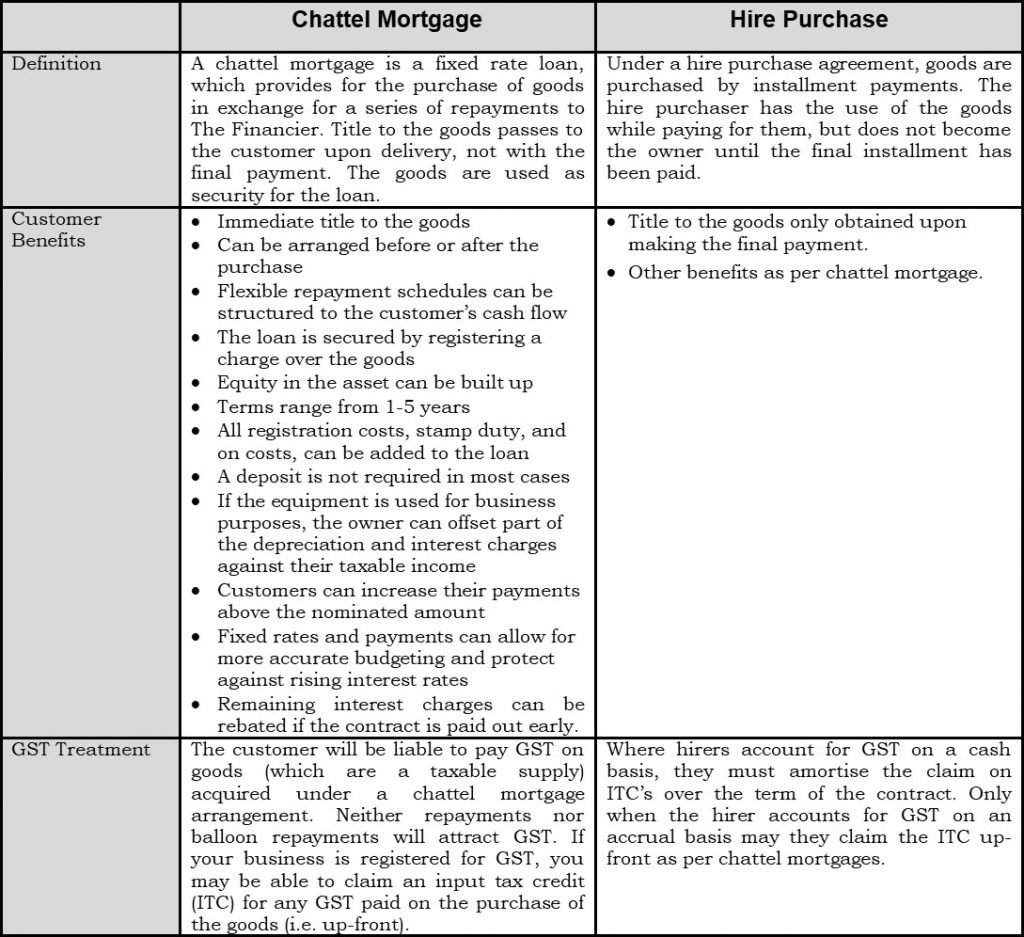

A Chattel Mortgage is different. The words ‘Chattel’ and ‘goods’ are effectively interchangeable, and it is an increasingly popular method of arranging Equipment Finance. In many ways it is rather similar to a Commercial Hire Purchase (CHP) and I will go into further detail outlining the main differences later.

Is it a new product?

No. The product has been used by financiers for decades, albeit a much more popular product following the introduction of the GST in the 2000/2001 financial year. The product was used to give financiers better comfort on certain assets, including ships and planes which could travel internationally, and therefore fall outside the legal boundaries of Australia.

Why the word ‘mortgage’?

The loan is secured by registering a charge over the goods. A charge allows the financier to register their interest in and security over the particular asset. This mortgage is lodged with the Australian Securities and Investments Commission (ASIC) who allocate a fixed charge number to the finance agreement. Upon sale of the equipment the loan must be repaid in full and the fixed charge must be removed by ASIC.

Who has effective title of these goods?

Ownership of the goods rests with the business entity from the outset. Title flows directly to the customer, which differs from a CHP where ownership is passed only after the final payment to the financier. Interest expenses and provision for depreciation is generally tax deductible.

What is the single key benefit of this product for a borrower?

It is especially beneficial for smaller businesses that are on the Cash Method for GST purposes, as it is the only product that allows claiming 100% of the GST cost in their next BAS statement. Those on the Cash Method of GST are typically businesses with annual turnover less than $1 Million.

Do I have to finance the whole purchase price?

No. A deposit towards the new purchase in the form of cash or trade in is available.

What about the interest rates?

Rates are typically identical whether you choose a CHP or Chattel Mortgage.

What are the pros & cons of this product?

Advantages

- Tax ownership of equipment with lessee – therefore allowing the lessee to claim GST back in full in next BAS statement (as if the item was paid for in cash).

- Unlike a CHP, no stamp duty is payable on monthly payments. Therefore monthly payments are less.

- Flexibility of balloon values and deposit amounts.

- Less expensive method of financing higher value capital equipment items.

Disadvantages

- Relatively high up front establishment fees/legal fees/documentation (although most lenders will allow you to capitalise these costs).

- Stamp duty is payable up-front. It is calculated at 80 cents per $200, and is based on the amount financed.

- A Chattel Mortgage becomes more cost effective for larger transactions – it is a relatively expensive product for less expensive items (< $50,000) due to the fixed statutory costs.

Product Example

A Quarry owner has decided to purchase a new item for their operations. The owner is unsure of the costing comparison between a CHP versus a Chattel Mortgage.

Item: New Hydraulic Excavator

Amount: $300,000 inc. GST

Term: 60 months

Balloon: Nil

Despite the larger establishment costs, The Chattel Mortgage in this example reflects better pricing than the CHP.

Conclusion

As with all financial matters, we recommend you seek advice from your external accountant in relation to the most tax effective product for your business. Please feel free to contact Mark Whitla, from Heavy Equipment Finance Australia (HEFA), also known as Melbourne Finance Broking Pty Ltd, on 0402 028 733 for no-obligation competitive quotes for all your equipment financing requirements.

Mark Whitla, Associate Director, Melbourne Finance Broking Pty Ltd

Comparison of Chattel Mortgage and Hire Purchase

You must be logged in to post a comment Login