ERR 2021/22 Annual Statistical Report

DR ELIZABETH GIBSON, General Manager of CMPA reports on the ERR 2021/22 Statistical Report.

Earth Resources Regulation (ERR) has recently released the 2021/22 Annual Statistical Report (available at www.earthresources.vic.gov.au).

The upturn in annual construction material tonnages continues to its highest level ever. However, it was noted that ERR had amended the tonnages for the previous four financial years (in comparison to figures shown in the relevant past statistical reports).

Due to these amendments, published comparison figures for past rock type ($/tonne) cannot be presented with any accuracy.

Table 1. Rock type and $/tonne for 2021/22

| Rock type | Production (million tonnes) | Value of Sale ($million) | $/tonne (2021/22) |

| Hard Rock | |||

| Basalt | 27.87 | 474.62 | 17.03 (16.94) |

| Granite | 6.65 | 133.97 | 20.15 (18.81) |

| Hornfels | 7.26 | 141.05 | 19.42 (19.96) |

| Quartzite | 0.08 | 1.51 | 18.88 (26.50) |

| Rhyodacite | 2.16 | 51.31 | 23.76 (23.12) |

| Schist | 0.43 | 9.71 | 22.58 (23.90) |

| Slate | 0.06 | 0.95 | 15.83 (6.35) |

| Trachyte | 0.03 | 0.64 | 21.33 (27.00) |

| Soft Rock | |||

| Clay and Clay shale | 2.74 | 4.35 | 1.59 (2.52) |

| Limestone | 2.02 | 35.86 | 17.75 (16.95) |

| Sand and Gravel | 16.48 | 247.36 | 15.01 (15.32) |

| Scoria | 0.95 | 18.38 | 19.35 (16.77) |

| Sedimentary* | 2.75 | 33.76 | 12.28 (10.49) |

| Soil | 0.13 | 1.13 | 8.69 (7.20) |

| Tuff | 0.24 | 2.31 | 9.625(11.30) |

| TOTAL | 69.91 | 1156.90 | 16.55 |

Sedimentary* (usually rippable rocks including sandstone,

shale, siltstone, chert, mudstone, claystone)

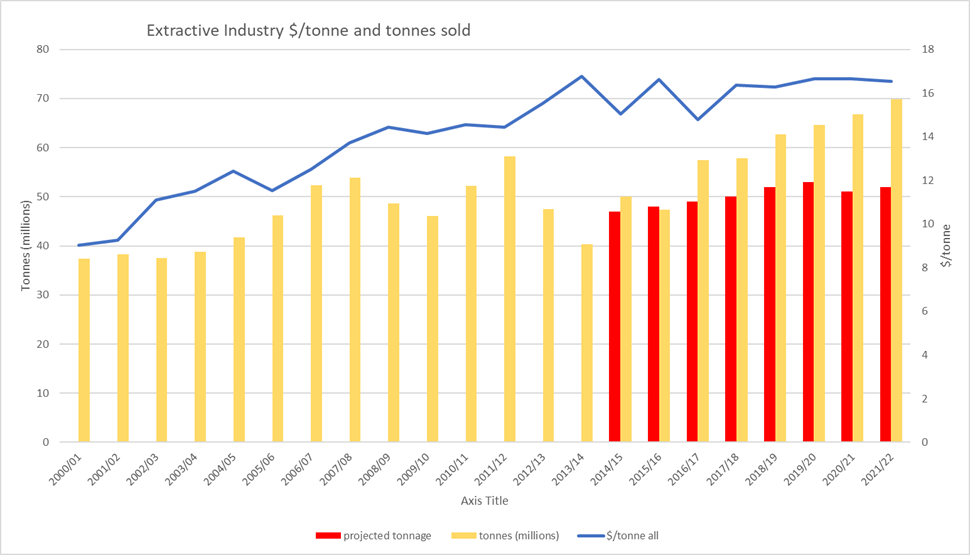

Figure 1 gives the production in tonnes; $ per tonne and projected tonnes of construction material against the financial year. It can be clearly seen that the:

• Extractive Resources Supply and Demand Study 2015-2050 underestimated the future needs for construction material in Victoria by approximately 26% for 2021/22.

• Of interest is the steady increase in tonnages of construction material over the past 7 years.

• The average unit rate ($/tonne) has remained essentially the same over the last 3 financial years.

Figure 1 Extractive industry $/tonne and tonnes sold by financial year.

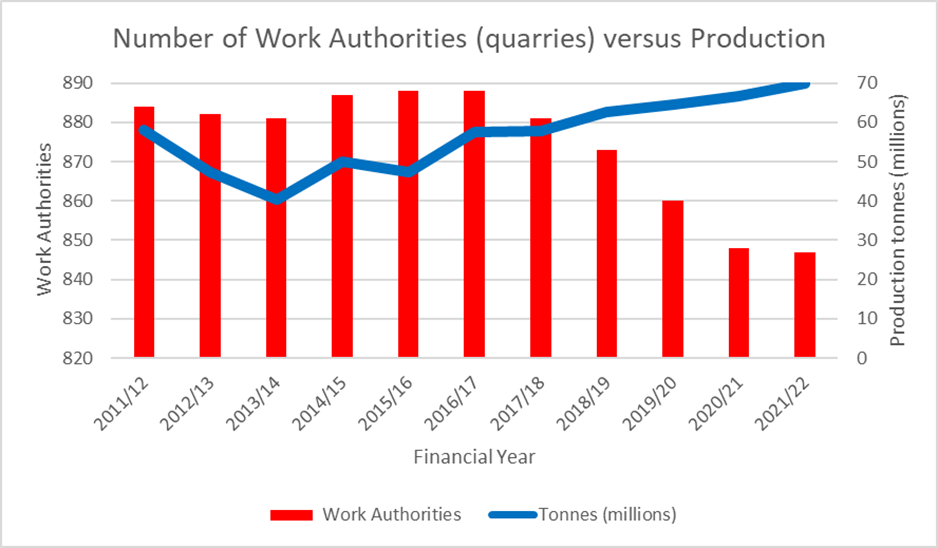

Figure 2 raises concerns that the total number of Work Authorities is declining as highlighted in many previous years, whilst production is increasing. Not included in Figure 2 are the tonnages for the production of recycled construction and demolition waste which is approximately 6.5 million tonnes in Victoria (2019/20), https://www.sustainability.vic.gov.au/research-data-and- insights/wastedata/annual-waste-data-reports

Figure 2 Number of Work Authorities against tonnages produced by financial year.

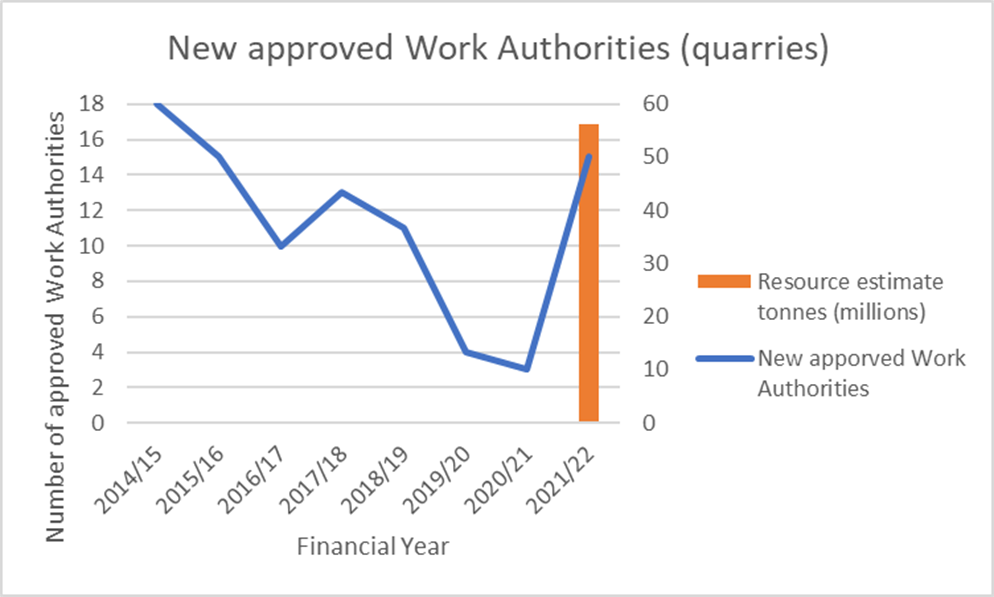

Figure 3 highlights the concern of declining work authorities overall. For work plan/work plan variation approvals 2021/22 looked to be a good year with data being accessed from Earth Resources Regulation’s GeoVIC showing 15 approvals (compared with 3 2020/21 and 4 2019/20). However, on further analysis: 6 were limestone quarries, 2 were <5 hectares, 1 windfarm quarry, 4 were >250 km and 1 was >200 km from Melbourne.

This left 1 new, small granite quarry in the Macedon Ranges to serve as replenishment for the 2021/22 Melbourne market. Clearly, the current low rate of replenishment of supply of construction materials is unsustainable. The provision of the resource estimate for the first time for 2021/22 is most welcome. However, a large proportion of quarries approved were limestone producers which makes up only 2% of the total production for 2021/22.

Figure 3 New approved Work Authorities against financial year.

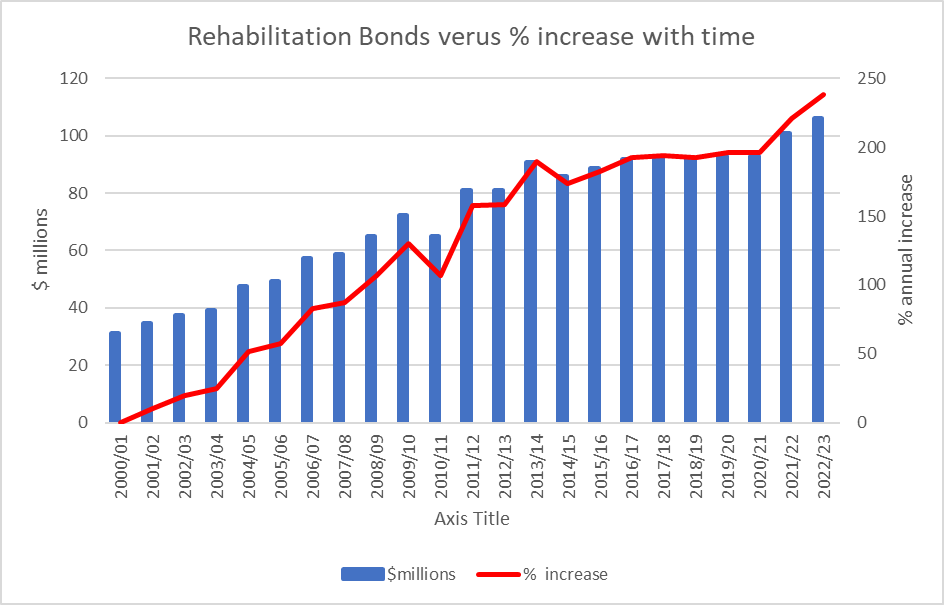

Figure 4 demonstrates a sharp percentage increase (despite a corresponding decrease in the number of work authorities) in the total rehabilitation bond for the extractive industries starting in 2021 as ERR’s revised rehabilitation bond calculator makes impact. At this time of writing CMPA is still waiting to have a meeting with ERR (as directed by the Minister for Energy and Resources in a letter dated 5 March 2023) to consider without prejudice the recommendations in CMPA’s Rehabilitation Project Report 2022. Note: no exception by Government on rehabilitation of quarries was published in the 2021/22 ERR statistical report.

Figure 4 Rehabilitation bond value versus % increase with financial year.

You must be logged in to post a comment Login