Financial Management Webinar

GAVIN MOREIRA, Member Services Manager for the CMPA reports on the Financial Management Webinar.

On 4th April 2023, the CMPA held a vital one hour webinar to inform Members on how to best stay ahead of the game under the current economic conditions. The webinar attracted 21 members and was for owners, managers, supervisors and accounts staff.

The first presentation was on Cost of living and rising inflation impacts by Chief Economist, Alan Oster from the National Australia Bank. Alan is expecting the economy to contract: growth in 2022 (January – December) was 2.75%; for 2023 it is predicted to be just 1.7%. The US and NZ are predicted to have a recession in 2023.

Currently, lending interest rates are still low but the rate of change of increase has been very high. A large number of clients will be moving from a fixed loan to a variable loan. How will consumers respond is the big question? So far OK though there are signs of a little slowing. House prices are down ~-11% but this may decrease to ~-5% – so asset prices are down also.

Inflation is seen as a supply issue bought about by the Russian war on Ukraine. Inflation is 6.75% and may increase to 7% but will come down as more businesses pass on reductions. However, there is much nervousness around large magnitude wage increases with the labour market very strong.

Consumer spending is relatively strong but not confident this will continue. Consumers have finished building their home offices. Unemployment has edged up slowly with Centrelink numbers showing it may get to 4% by end of the year. In the medium term there is optimism about the economy with the Reserve Bank wanting to slow it down.

The second presentation was on Cashflow, Debtors and Pricing Strategies by John Pititto (CMPA Treasurer) and Partner for Mead Partners Chartered Accountants.

Profit v Cashflow

Profit does not equal cash. Monitor cash inflows and outflows. A business that can’t pay wages is no business at all. Plan Ahead. Tips for putting together a cash flow forecast are – Keep it Simple, Standardise and Measure your accuracy and performance. The important thing is to just start doing it. Bigger does not mean better. Plan for growth and be aware of increased working capital and capital expenditure. Does growth mean more Profit? There are risks and rewards.

Debtors

Stay on top with constant contact. Don’t take for granted that customers will pay. Review Debtor terms. Stop a bad debt before it’s too late. Don’t allow customers to extend credit terms. Maintain a credit profile on all customers. Credit checks on new customers are mandatory. Watch out for the warning signs of a bad debt.

Don’t rely on particular customers. What % does 1 or 2 large customers make up of your total debtors? What impact will it have if you lose the customer? Aim for an even spread of customer size. Don’t lose new or existing customers due to focusing on your large clients.

Manage your Statutory Payments, talk to the ATO before it’s too late. Payment arrangements are available in some cases. Directors need to be aware of their personal obligations.

When did you last review your pricing?

Your pricing strategy can make or break your business success. Reviewing your pricing strategy is more important than ever before. However, if it’s been a while since you last reviewed your pricing – or you never have – you may not know where to start.

What is a pricing strategy?

It’s the method to how you price your product or service to maximise profits, create value, drive demand, and outperform your competitors. It needs to be specific to your business and be directly linked to your business and revenue goals. This ensures your pricing is supporting your business strategy and driving growth in the areas you need.

The benefits of regularly reviewing your pricing strategy are to:

• Understand your true profit per sale

• Identify growth and revenue opportunities

• Discovery margin leaks and decreases

• Uncover cash flow impacts and roadblocks

• Better position your product / service in the market

By identifying your projected profit for each sale, you can also better plan and manage external impacts such as supply shortages, labour increases and other unknown setbacks. Quite often businesses are unknowingly undercharging products and services, directly impacting cash flow and creating trading losses.

What are the triggers for a pricing strategy review?

• Large fluctuations (up or down) in sales

• Not being able to keep up with demand

• Cash flow decreases, short or tightness

• An increase in businesses loss or costs

• Changes in competitor pricing, the market or industry

• No price changes for a long period of time

To maximise growth, you should (at a minimum) review your pricing strategy annually alongside your business strategy and goals. By reviewing your financial and operational data, you can undercover key insights to drive the direction of your strategy, including:

• What products and services are costing you money

• Where there’s opportunity for growth or margin increase

• How to improve cash flow and increase profitability

• What is causing margin leakage or profit loss

You should also consider external factors and impacts like, Increases or projected increases in third-party pricing or subscriptions. Changes to competitor pricing or pricing approaches. Changes and fluctuations to market supply and demand. By regularly monitoring your pricing, you can identify further trends or insights that could impact your profitability and financial performance.

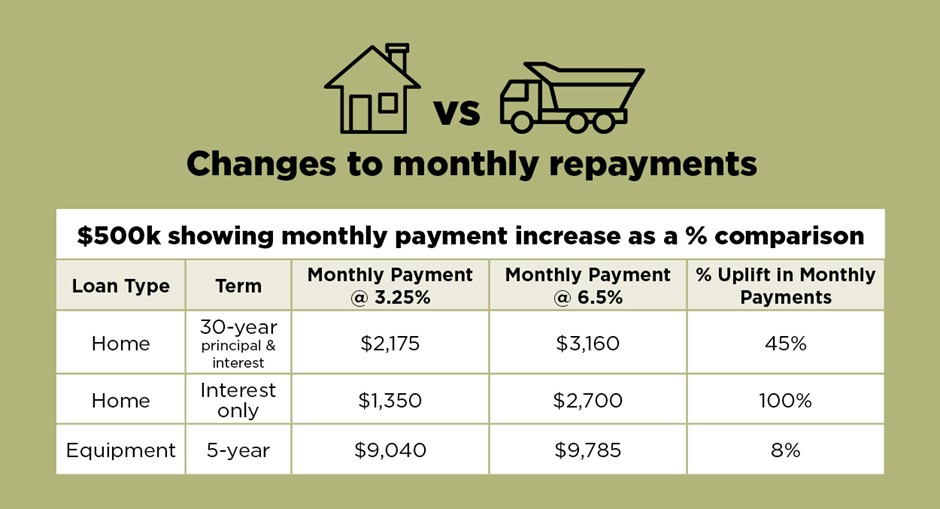

The final presentation was on Equipment purchasing and obtaining finance by Miles Beamish, Senior Partner of Finlease. Miles provided a background picture to how finances were affected by COVID over the last two years, looking at low interest rates, a cashed up market and demand and supply for products. Then came high inflation and with it of course many increases in interest rates. The RBA estimates that around 23% of all Aussie home loans – worth almost $500 billion worth – are fixed rates and will switch to variable rate by the end of 2023.

Equipment Finance

In 1992 interest rates were at 18%, what is the effect on monthly payments on $1 million financed over 5 years with a 30% balloon. At 4% = $13,900 p/m or at 18% = $22,300 p/m.

Unlike home loans where a doubling of the interest rate resulted in an increase of 45% or 100% in the monthly payment, the monthly payment effect on the equipment finance loan was much lower at around 8%. This is simply due to the shorter term where the entire debt is fully paid off over 5 years.

Spread your equipment finance debt!

Create a broad base of lenders who will support your growth. Multiple lenders creates competition for your business. A broader spread of lower individual debt levels keeps the chains & shackles away – No need for a GSA. If your bank has a GSA, there will be less overall debt subject to a Company Mortgage. Keeps your Powder Dry for Working Capital &/or Property Loans.

A reminder the TFEDA (100% write off) window closes on 30/06/2023 (see article on page 33-34).

David Gallagher – Financial Controller, also attended the CMPA webinar “The take home (message) from the webinar was about debtors …. the webinar reminded me not to be complacent.”

You must be logged in to post a comment Login