Financing Tax Debt

MILES BEAMISH, Senior Business Finance Broker from Finlease reports on ways to finance your tax debt.

Statistics say up to one third of small businesses are under some form of ongoing Tax Debt with the ATO. The uncertainty of these arrangements and the issues they can potentially cause when companies apply for other finance with mainstream lenders, it is encouraging to see a number of property financiers are now assisting companies in Tax Debt Finance.

These property financiers are assisting with Tax Debt Loans through providing additional funds against residential and commercial properties at levels up to 75% of market value and at interest rates of 6.5% or less.

These refinancing structures not only provide the ability to Finance Tax Debt at substantially lower costs than ATO rates, these Tax Debt Financiers provide help with Tax Debt over much longer terms. The longer term structures substantially reduce pressure on existing cash flows and by doing so provide the ability to Finance Tax Debt in a much more stable environment, minimising the chances of the ATO taking action against the company.

Even where there is insufficient equity in the properties to cover the entire Tax Debt, this partial refinancing in concert with assisted ATO negotiations has often lead to a substantially improved arrangement with the ATO, including reduced penalties and interest as well as a more sustainable payment arrangement with the ATO for the balance of outstanding Tax Debt.

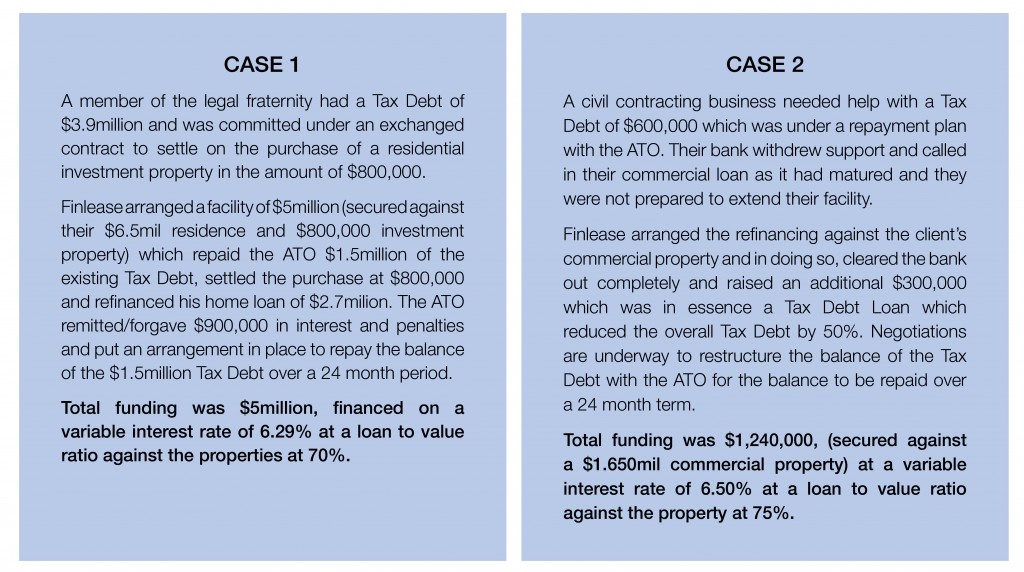

Below are two recent case studies which gave our clients the Tax Debt Help they needed.

It is important to note in both cases, the Tax Debt Financiers who were different companies were BOTH prepared to advance funds whilst our clients were and continue to be under ATO Tax Debt repayment schemes.

Finally it is important to note there are other ways to Finance Tax Debt even where there is not sufficient equity in company owners’ real estate assets.

Tax Debt Finance continues to be provided through a combination of selected debtor discounting facilities in concert with interest only loans against unencumbered plant and machinery.

Many companies who require Help with Tax Debt are often cash poor and asset rich with a significant amount of wholly-owned items of equipment which can provide excellent security for Tax Debt Loans.

Although this process is slightly more expensive than property secured facilities, it is an excellent short to midterm way of Financing Tax Debt and in doing so both removing the uncertainty of being faced with unexpected ATO action as well as ensuring a company’s access to low-cost mainstream financiers for future equipment and property finance needs.

For further information contact Finlease. We have 13 offices Australia Wide and have been looking after business owners in capital intensive industries for over 25 years.

Miles Beamish

– Senior Business & Equipment Finance Broker

M. 0410 774 506

E. [email protected]

W. finlease.com.au

You must be logged in to post a comment Login