TAX BREAKS…What it all means

The 2009 Federal Budget has been announced! Here MEAD PARTNERS further explains Small Business and General Tax Breaks.

WHILE the legislation is still not law yet, there have been some significant amendments to the Exposure Draft that you should take into account prior to committing to significant capital expenditure.

Do you qualify for the 30% Investment Allowance? As detailed in the last edition of Sand & Stone, Mead Partners provided a summary of the Exposure Draft that was released for public comment on the 23rd February 2009. Since then there has been a number of questions raised and clarification has been sought on a number of aspects of the legislation.

SMALL BUSINESS TAX BREAK EXTENDED AND INCREASED

2009 Federal Budget Announcement!

The Small Business and General Business Tax Break will be expanded to allow a bonus deduction of 50 per cent to small businesses with a turnover of less than $2 million that acquire an eligible asset between 13 December 2008 and 31 December 2009 and install it ready for use by 31 December 2010.

The previously announced 30 per cent and 10 per cent bonuses will continue to apply to all other businesses.

When will it be law?

On the 19th March 2009 the Tax Laws Amendment (Small Business and General Business Tax Break) Bill 2009 was introduced into Parliament. Parliament will sit again after the 12th May 2009 and we should see the Exposure Draft become law after that date.

What does ‘new’ mean?

New refers to assets that have not been used before by anyone, anywhere. The tax break will be for new, tangible, depreciating assets or new expenditure on existing assets. Where an asset has only been used for reasonable testing and trialing the asset can still be classed as new. Therefore second hand assets do not qualify even though it is a new asset to your business.

Will assets under leases qualify?

Yes, BUT be aware that under a lease you are not the owner of the asset and therefore cannot claim capital allowance deductions (depreciation) except for luxury cars. Therefore the lessor (finance company) is entitled to the deduction, not the lessee. This is important to note when purchasing a new asset under finance. As is the case with capital allowance deductions, how the Tax Break is factored into lease prices will be a matter for your commercial negotiations. It should also be noted that Hire Purchase agreements and Chattel Mortgages you are deemed to be the owner of the asset and are therefore entitled to the tax break.

What if I have private use?

As the draft legislation currently stands it states that the asset must be used for, ‘the principle purpose of carrying on a business’. This is not defined in the Bill or the Income Tax Act 1997 and therefore takes its ordinary meaning. There is little authority regarding the meaning of principle purpose, but from the limited commentary that exists, if the business use is greater than 50% it may qualify. However, given the apparent lack of guidance regarding the precise meaning of principal purpose, care should be exercised when applying the bonus deduction to assets that are used for private purposes.

Are Primary production assets depreciated under Div 40-F eligible for the tax break?

No. If assets already receive concessional capital allowance deductions under other sub-divisions, such as assets used for primary production depreciated under sub-division 40-F, they will not qualify for the tax break.

What if I don’t meet the June 2010 Installation deadline?

If you acquire or start to hold an eligible asset between 13 December 2008 and the end of June 2009 and miss the end of June 2010 installation deadline you will miss out on the 30% bonus deduction.

However, provided the asset is installed by the end of December 2010 you will still qualify for the 10% bonus deduction.

Example 1: A small business (i.e., turnover of less than $2M) purchases a crusher for $80,000. The crusher is above the relevant threshold and in addition to any depreciation that would normally be claimed the tax break is available, calculated as follows: $80,000 x 50% = $40,000

Example 2: A business that is not a small business (i.e., turnover of more than $2M) buys a crusher for $80,000. The crusher is greater than the relevant threshold and in addition to depreciation it is entitled to the tax break, calculated as follows: $80,000 x 30% = $24,000

Please note that in order to be entitled to the above concessions, the assets must be purchased and installed ready for use within the relevant dates previously mentioned.

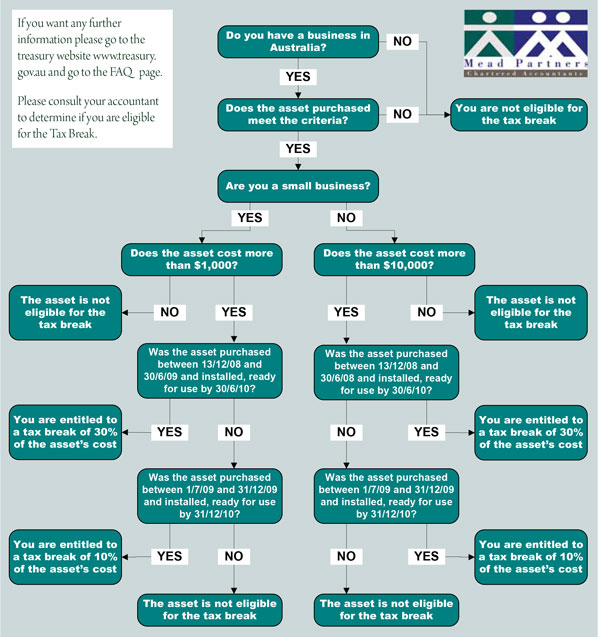

To check your eligibility please see our handy flow chart below.

You must be logged in to post a comment Login