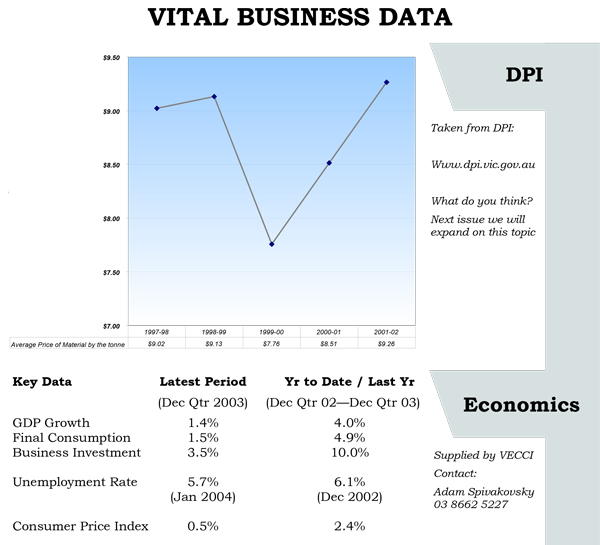

Vital Business Data

SUPER PENALITIES TO APPLY

Employees are obliged to remit superannuation guarantee contributions (SGC) to the Australian Taxation Office on a quarterly basis as from the commencement of this financial year.

Previously businesses had the option to contribute annually but this has been altered as from July of this year. Contributions have to be made for the quarters ending in September, December, March and June. They must be paid no more than 28 days after the end of the quarter. If the SGC contribution is received late, then the employer will be liable for a charge which includes the contribution component, an interest component and an administration levy. This charge would not be tax-deductible.

Contractor tax ruling

The Australian Taxation Office has released a detailed tax ruling dealing with expenses which can be claimed by an individual delivering their services through a company, partnership or trust.

If a service provider works from a home office, the new ruling states that the costs of heating, cooling, lighting and furnishing the home office can be deducted, but not part of the mortgage interest payable.

Other rulings include car running expenses which are fully deductible if the car is used only for work purposes. If only a portion is used for work, then the personal use must be separated out and those costs identified.

Techlink to assist smaller business

The Federal Government’s new Industry Techlink scheme provides free technology information and advice for small and medium-sized businesses.

The service acts as a clearing house of information for smaller businesses which are uncertain about sourcing new technology or implementation issues.

The advice will be delivered via the telephone or email.

For more information telephone 1800 111 485 or see website.

You must be logged in to post a comment Login